We’ve talked before about how simplifying life and reducing clutter can lead to more freedom, less stress and all sorts of awesomeness. How debt is a burden around your neck that keeps you from living the lifestyle of your dreams.

It’s true… but how do you get to financial freedom? How do you live a frugal life and reduce your debt? where do you even start?

Well, it can actually be pretty simple.

I owe a lot to the Dave Ramsey method. Dave Ramsey is a very popular author and radio show host that keeps it simple – because most people who are in debt need it kept simple.

Below are Dave’s “Baby Steps” to getting out of debt. Follow along and before you know it, you’ll be debt free 🙂

1. Start a $1,000 emergency fund

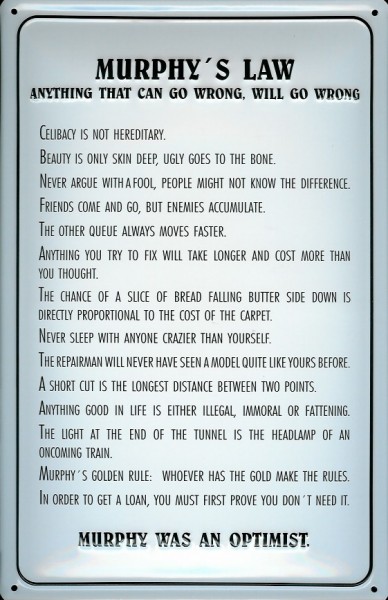

This is just peace of mind. It’s “Murphy repellant”, i.e. that old saying, “Anything that can go wrong will go wrong”. Bad shit is gonna happen, there’s no way around that. So having this emergency fund turns those “big emergencies” Â (like a car repair) into little things.

It’s also a nice reminder that if you scale this emergency fund out really big, you get an idea of what life would be like to live like that. It starts you on the path to amassing savings, which in turn allows you to live a lifestyle of freedom and less stress.

2. Pay off your debts from smallest to largest – i.e. use the Debt Snowball Method

So here’s the painful part. Write down all your debts from smallest to largest. I suggest using a spreadsheet like Excel.

It’s just like stepping on the scale and seeing your weight, but it’s something you HAVE to do in order to repair your finances. Just bite the bullet and do it. It’s really not that bad or difficult!

Once you have your debts listed, start paying everything you can on the smallest one.

Now, don’t get fancy and worry about interest rates. The reasoning behind this is that’s how we get into financial trouble in the first place. Don’t try to outsmart anything, just START PAYING STUFF OFF.

Also, when you pay off the smallest thing first you see something happen: you actually pay it off and cross it off your list! Success! You actually see these victories and that pumps you up to keep going.

Then, when you pay off your first credit card bill (or whatever form of debt it is), you take the money you were putting towards that and use it to pay off the next thing. Soon, the money you put towards debt begins to grow and grow, it becomes a snowball that rolls downhill, attacking all your debt.

This gets you excited about it, prompting you to do more to attack your debt, like maybe get a part-time job or sell some stuff. It’s really pretty empowering!

3. Accumulate 3-6 months of expenses in savings

Here we’re getting back to having some solidity and safety. We don’t want to sink money into investments just yet. You need some money around for security. You’re expanding that $1,000 emergency fund form step 1.

What happens if you or your mate loses a job? What if you unexpectedly need a new car? What if something happens to your house?

Shit happens in life and having a 3-6 month emergency fund (or more money) makes you feel fantastic.

Suddenly the “big stuff” in life isn’t so big anymore. You can afford to slow down a bit and smell the roses. Sure, a car repair bill of $1000 sucks, but you can afford it. It becomes a minor thing.

And soon enough EVERYTHING dealing with money becomes a minor thing.

If you live life this way you begin to see how money is simply ammunition. You don’t fear not having enough of it – instead you begin to see ways to make more of it!

Before you know it, you’ll arrive at financial peace. It’s one of the best things you can do for your life and your family!

_________________________

There are more steps to Dave Ramsey’s plan, but we’ll leave it at that. This is all you really need to get going. He goes into investing which is where many people could disagree with him. But the first 3 steps we laid out here are awesome!

Believe me – I used these steps and paid off over $20,000 of debt in about 3 years. Since then, I amassed another $20,000 in savings and was able to quit my job and start working on projects like this here website.

It’s powerful, and many other people have done the same. And you can too!

Here’s Dave Ramsey’s book again – we highly recommend it!

Good luck on your journey and…

ROCK LIFE OUT!